Inflation and no Growth points to Deflation

The Week Ahead 4/4/2022

Last Week Summary

The S & P 500 squeaked out a gain during the last few minutes of the trading day on Friday. At the beginning of the week there was a run up to 4630 area and then a slow grind back down to the open at 4530 area with a run to 4510 where major support was reached.

April is considered by many to be a strong month. However there are some headwinds that the market needs to digest before making new highs.

Investors want to know if we are going to see a repeat of 2018 taper tantrum happened.

They will look at the Federal Open Market Committee (FOMC) minutes to see the likelihood of a steeper increase in short term interest rates. With the Yield Curve already inverted, the FED looks like they are caught between a rock and a weird place. Raising Rates, inverts the yield Curve but keeps inflation in check. Keeping rates lower, inflation runs, but the yield curve will not invert as much. In the past, an Inverted yield curve serves as a precursor for a recession. Since 1956, every recession was preceded by an inverted yield curve.

A yield curve is the relationship between short-term and long-term interest rates of fixed income securities, like bonds. a healthy bond market shows interest rates on longer term bonds are more than short term bonds. When this reverses, it indicates that there is more risk in the economy. Remember though, an inverted yield curve is not the catalyst, just an indication. A red flag so to speak.

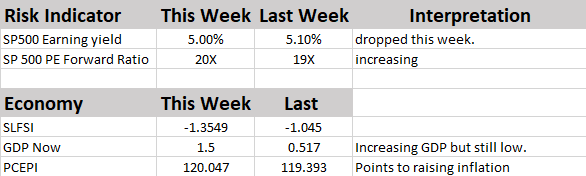

Here is some good SP 500 data points from the people of Trinity Asset Management:

The forward 4-quarter estimate fell this week to $227.28 from last week’s $227.41.

The PE ratio on the forward estimate is 20x;

The SP 500 earnings yield fell sharply to 5% from 5.10% last week and 5.39% two weeks ago. For comparison, in December ’18, the SP 500 hit 7% near the bottom for that Q4 ’18 correction.

With just one week left in Q4 ’21 earnings, neither Q3 ’21 nor Q4 ’21’s bottom-up SP 500 EPS estimate will exceed $55, which I thought it would. Both quarters will come in around $53 and change;

The IBES data is still expecting 8.8% SP 500 EPS growth for calendar 2022. We’ll know within the next few weeks as Q1 ’22 earnings start in 10 – 15 days;

My opinion is that we have a sharper correction ahead for the SP 500, but whether that’s this week or the next quarter or by year-end is unknown.

FED

Strikingly, several Fed officials issued some personal opinions in the days following the FOMC meeting about how they think the Fed might have to think about removing policy accommodation.

Mr. Bullard (arguably the biggest hawk at the Fed) said he thinks the fed funds rate should be above 3.0% this year.

Fed Governor Waller said he favors the Fed front-loading its rate hikes, which could entail raising rates by 50 basis points at one or more meetings in the near future.

Minneapolis Fed President Kashkari (arguably the biggest dove at the Fed) acknowledged that he moved his SEP submission for the fed funds rate for year-end 2022 from 0.50-0.75% in December to 1.75-2.00% in the most recent SEP and said the Fed may need to get modestly above neutral while inflation dynamics unwind or even move to a contractionary stance if the economy persists in a high-pressure, high-inflation equilibrium.

Fed Chair Powell, in a speech for the NABE Conference, reiterated that the Fed will be more aggressive if necessary to ensure a return to price stability, including raising the fed funds rate by more than 25 basis points at a meeting or meetings and tightening beyond common measures of neutral and into a more restrictive stance if needed.

Cleveland Fed President Mester thinks a fed funds rate of 2.5% by year end looks appropriate.

Chicago Fed President Evans expects the federal funds rate at 2.75-3.00% by the end of 2023 and 2024.

What was peculiar about all these remarks is that they were made despite an awareness that peace talks between Russia and Ukraine are getting bogged down. Recall that the Fed took a more conservative step with the first rate hike, predominately because of the uncertainty surrounding the Russia-Ukraine situation which is still highly uncertain.

From Briefing.com

Key Charts

SP500 Market Chart

I always start my personal review of the week by looking at a great chart. This week I am featuring Jill Mislinski. She includes a lot of relevant information in a single picture – worth more than a thousand words. Read the full post for more great charts and background analysis.

Quant numbers show that the earnings are starting to decrease as prices are increasing. the Fed Data shows that the Economy is ok and GDP is at a meager 1.5% but increasing. Inflation still high.

Anti - FUD report

Each week I break down events into good and bad. For our purposes, “good” has two components. The news must be market friendly and better than expectations. I strive to avoid using my personal preferences in evaluating news – and you should, too!

Good

It was hard to find some positive economic news, but one thing that I saw this weekend was that the NCAA championship lineup was decided yesterday in New Orleans. In the Final Four matchup that will go down as one of the best, North Carolina defeated Duke 81-77 and will head to the national championship game against Kansas on Monday night at the Caesars Superdome in New Orleans.

The crowds were there spending money in New Orleans.

Bad

Recession warning sign flashes as yield curve inverts

On Friday, the yield on the 10-year U.S. Treasury bond ended the day at 2.38%, 6 basis points below the 2-year U.S. Treasury yield of 2.44%. This phenomenon has a strong track record of predicting a recession; each of the last eight recessions (dating back to 1969) were preceded by the yield on the 10-year falling below the 2-year.

War in Ukraine - Seems like the war is not spreading this week and is contracting to a portion of Ukraine. Still bad, but not ugly.

Ukrainian forces will conduct successful small-scale counterattacks, but Russia's steady advances in the Donbas region will weaken Ukraine's negotiating position, as Russia will not consider a cease-fire until after it has secured the Donbas.

Ugly

The announcement has sparked panic-buying and confusion throughout the city, where centralized quarantine facilities are already overloaded. The limited use of robots to announce safety measures in a few areas made headlines this week, but the majority of the work continues to be done by public health officials working with ubiquitous residents’ committees, which maintain a close watch over their neighbors.

China mulls COVID-19 restrictions in Shanghai. Shanghai's two-phase COVID-19 lockdown is supposed to end on April 5, but reports of measures for phase one (for eastern Shanghai) being extended suggest that phase two may also be extended. The way Chinese authorities handle the Shanghai lockdown will indicate how they will likely handle China's other lockdowns, mainly in Jilin province. It seems likely that officials will extend some restrictions if authorities are not confident that the spread of COVID-19 is contained. Meanwhile, the Qingming Festival public holiday in China will last from April 3-5, but normal holiday bumps to spending and travel will likely be reduced this year as COVID-19 restrictions and safety concerns about travel weigh on citizens. - From Stratfor.com

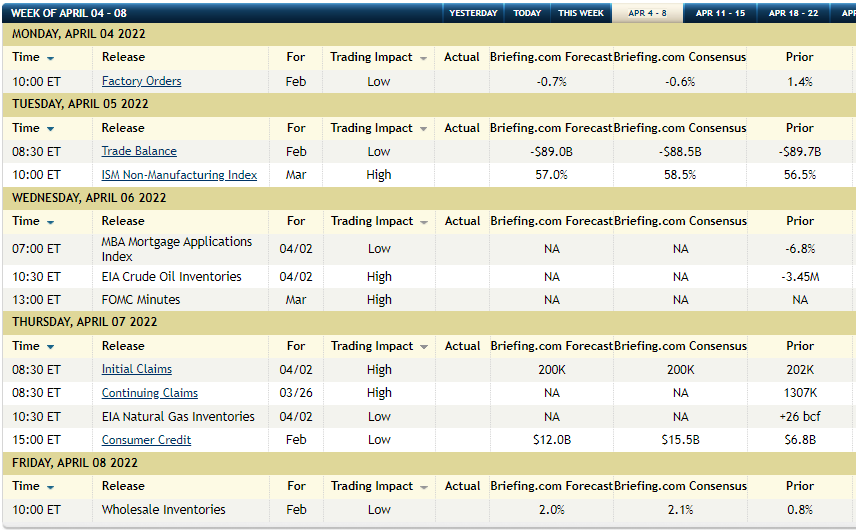

Economic Calendar

Briefing.com has an excellent weekly calendar and many other useful features for subscribers.

Last weeks numbers

Nonfarm payrolls rose by 431,000 – less than expected but with upward revisions to January and February (a 562,000 monthly average in 1Q22).

The unemployment rate fell to 3.6%, which is where it was before the pandemic.

Personal income rose 0.5% in the initial estimate for February (+6.0%), led by a 0.9% gain in private-sector wages and salaries (+12.6% y/y).

Inflation-adjusted disposable income fell 0.4% (-1.6%)

Personal spending rose 0.2% (-0.4% adjusting for inflation)

The PCE Price Index rose 0.6% (+6.4% y/y, well above the Fed’s 2% goal).

Review of next weeks economic data.

Final Thought for Investors

Should we worry about the repeat of the 2018 taper tantrum. I say yes. If you can hedge, then hedging is the thing to do. Despite the economy looking ok, the market sure seems a bit elevated with several headwinds. If you are not able to hedge, raising cash is the next best thing.

We are entering into a phase of lower GDP growth and raising Inflation. The best asset classes will be Fixed income, gold, and Cash. Despite the increase of commodities, these and stocks will be hit. So be careful.

Great stuff Dr. Brad!

Great stuff, Dr. Brad!